Stone cold sober

Rise of LNA (Low to No Alcohol) beverages

In UK and Europe we have already seen the adoption of LNA through the shifting of drinking habits.

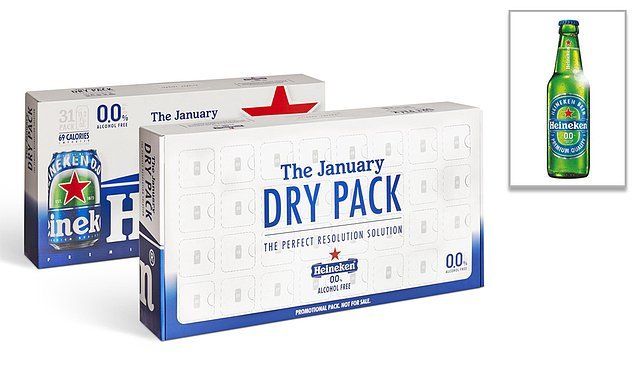

Major beer brands such as Heineken, Carlberg, AB InBev and Kirin have already penetrated the market with LNA beverages with many crafts beers following suit. However the major brands have seen this rise in opportunity as a complimentary product to their expanding portfolio and not a replacement for the core alcohol product.

“Non-alcoholic beer is meant to complement rather than replace beer, allowing anyone who wants to have a beer, to enjoy one during any occasion at any time of the day,… It is for those moments in life when the consumer wants a great beer but doesn’t fancy the alcohol or the effects of alcohol…”- Maud Meijboom (Heineken)

JAPAN

The Japanese market for LNA appears to be one of the most popular with consumption increasing not only for foreign craft LNA but even home brands like Kirin where the main driver seems to be health and wellness related. Kirin LNA beer is targeted at men and women over 20 years old who care about belly fat. According to a Kirin survey, 70% of adults in Japan were concerned about ‘beer belly’ hence the popularity in the beverage. Although currently this hasn’t become an adopted habit there have been a noticeable 320% growth in just 10 years with no indication of it slowing down. Kirin’s USP in Japan is that its managed to claim a FFC (food for function) label for it’s fat reducing properties which was granted in 2019.

WINE

The low – no alcohol trend is not limited to just the beer category. We have seen this trend spill into the wine and gin category.

New consumer moments have given rise to new drinking rituals where lighter, easier drinking moments are preferred with LNA beverage.

O.Vine is a brand carving its own market. Although the low alcohol wine category is nothing new, it’s popularity is also on the rise. The major differentiation with O.Vine is that they use the waste product of the wine process, the crushed seeds, skin and pulp, mixing this with lightly sparkling water to creates a lighter and more refreshing beverage that is not only low in alcohol for those easy drinking moments. O.Vine are concentrating on the gen x consumers from 30-55 + years old who use to like drinking wine but has now began seeking healthier alternative with low alcohol, calories and sugar.

GIN

There has also been a surging trend of food pairing with alcoholic beverages so it is only natural that this trend would eventually migrate to LNA category. We have seen many restaurants and bars introduce a wider non-alcoholic menu choice and more exciting mixology of mocktails driven by food pairing for enhanced flavour experiences. This idea of ‘lighter’ drinking experience isn’t new, it derives from the tradition of having aperitvos or a light pre-dinner drink. This was further supported by lighter social occasions such as lunches where strong alcohol drinking isn’t encouraged especially during working hours. Habits have shifted from hard drinking moments to savouring taste and experiential discoveries of ingredients and flavours.

These upsurge in opportunity moments have allowed relative young, new, fresh brands like Seedlip to carve out a distinct market space not currently occupied. Now placed in over 3000 top bars and restaurants with the backing of Diageo the brand has grown from a one man band in 2015 (stating out in Selfidges) to a brand of well over 40 people. It has become the poster brand for non-alcoholic spirits.

Seedlip tapped into the booming Gin market which exploded in recent year and as trends moved more towards easier drinking moments Seedlip seemed to have appeared at exactly the right moment. Taking cues from the Gin category, it soon became the alternative and go to brand fashionable cocktail concoctions. The combination of brand, storytelling and media hype/endorsements around Seedlip has contributed to its unprecedented rise to fame and it’s easy to see why when consumers are curtailing their drinking habits to healthier options.

BRAND EXPERIENCE

Whilst there has been rapid growth of the LNA category, there has also been many recent teething and regulatory issues within category and positioning of some brands.

That being said this movement does not seem to be dying down and there is predicted growth especially in the APAC region, once the Japanese Olympic get back on track.

We see consumers habits and trends spread, we must not ignore the role that design has to play in the adoption LNA products. The design of the product alone is no longer sufficient as consumers search more experiential experiences of key touch points and moments, whether it is paired with food or consumed solo. Consumers may be willing to compromise on alcohol levels of a beverage, however because they down traded on alcohol content, this doesn’t mean that they expect and less of a brand or consumer experience. In fact they are probably looking for a more enhanced experience to offset.

So how can design identify these key moments to amplify the consumption experience and elevate it so that it feels like the consumers are getting more and not less?

It could be in the presentation, pour, the mixology, the theatrics, but one thing is for sure, identifying these key opportunities moments and amplifying them is what will differentiate your brand from the next.

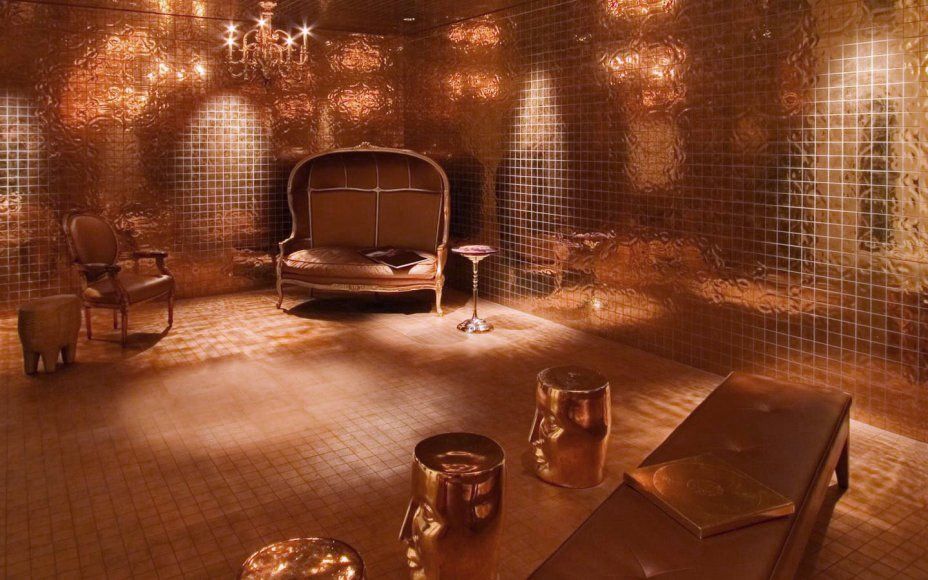

Experiential cues and model be taken from that of the fragrance world, like OLa Lab or Singapore’s own Brass Lion Gins where consumers learn about the mixology and create their own blends of non-alcoholic beer cocktails in a social setting?...

...Or do you create hyper sensory experiences that’s links back to and promotes the product (LNA) benefits like Bompas & Parr or experiential spaces which invokes consumptions moments like Tanqueray or Bombay Sapphire.

You could go as far as to creating pop up experiential bars of mixology and bespoke flavour pairings like lays chips to promote flavour pairings between beer and food as well as influencer and social PR.

It is no longer adequate to rely on just brand alone for consumer conversion and buy in (especially in this new category), that brand has to stand for something and has to offer a brand experience/elevated experience to match.

To see how WKD Studios can help you innovate on brand experience and touchpoints contact us on collaborate@wkdstudios.com